Much discussion takes place amongst practitioners, clients, and regulators about which type of financial advisor is best for clients. It is important to note that there are no strict regulatory requirements for claiming to be either, and some “fee-only” advisors may be a part of, or have ownership, in entities that offer commission-based products. Here are five questions to consider when choosing between fee-only vs. fee-based financial advisors.

Defining the Difference:

Fee-only advisors as the name implies charge clients only fees for their services. You can confirm if they are truly fee-only by reading their full, required regulatory disclosure. These fees are paid directly by the client. Typically, these fees take the form of a percentage of assets under management (AUM), a flat fee for financial planning, or a combination of both.

Fee-based advisors mostly charge clients a fee (similar to fee-only advisors). The primary difference is that at times they might also earn a commission paid by a company (not by the client) whose products are used to solve certain client needs for which there are limited or no fee-only solutions.

5 KEY QUESTIONS:

Do I need ongoing or onetime advice?

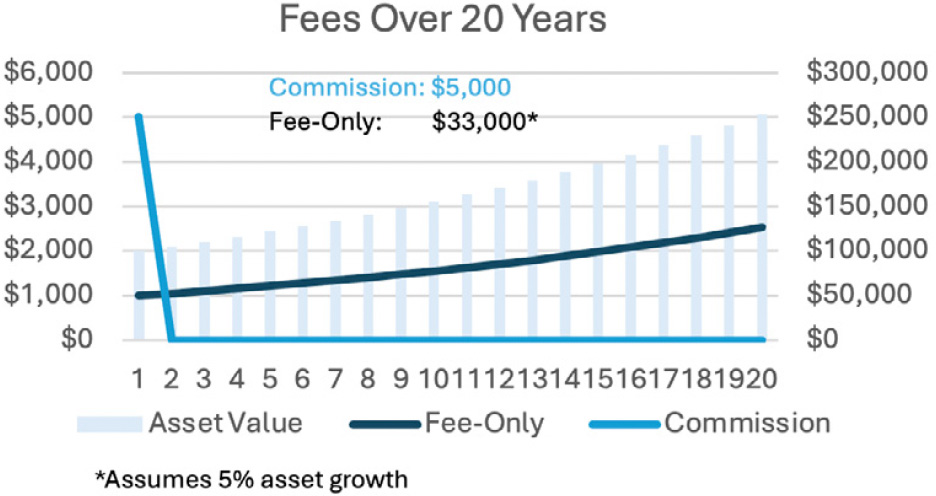

Do I need ongoing or onetime advice?The answer to this question can help determine which service model is right for you. If you have $100,000 to invest, the advisor’s annual fee might be 1% or $1,000. If your time horizon is 20 years, the cumulative fee will be north of $30,000 (assuming a 5% growth in asset value). Alternatively, the one-time commission to invest $100,000 might be around 5% or $5,000. So, while $5,000 is more than $1,000 in the first year, over the course of 20 years, $5,000 is much less than $30,000. If, however, you value ongoing advice, planning, and service, the fee-based model, while more expensive, might be the better choice for you.

Do I need comprehensive financial advice?

Both types of advisors should be able to provide a broad scope of financial services. These services include, among other things, wealth management, investment management, financial planning, retirement planning and estate planning. Feeonly advisors are limited to charging only fees for these services. This works well a lot of the time, however, it limits their access to certain individual financial risk management solutions. Products that transfer all or part of an individual’s financial risk to a third party (such as life insurance, longterm care insurance, disability income insurance, and annuities) are only largely available in the form of commission-based products, requiring fee-based advisors that can receive both fees and commissions. There is no right answer, but knowing whether you will need access to risk management products is an important question to answer when choosing what type of financial advisor to use.

Is the financial advisor a fiduciary?

The word “fiduciary” in the context of financial advice typically refers to the standard of care in which advisors are held under The Investment Advisers Act of 1940. Choosing to work with a financial professional that is a fiduciary is important because a fiduciary is obligated to act in a client’s best interest. Some financial service professionals loosely use the term fiduciary in their marketing materials, but only those officially registered with the Securities & Exchange Commission (SEC), or one of the states, are considered a true fiduciary. While the term fiduciary is often used synonymously with fee-only advisors, the reality is that both fee-only and fee-based advisors are considered fiduciaries under the 1940 Act. As of June 2020, Broker-Dealers and their registered representative became subject to the SEC’s Best Interest Standard, allowing both the SEC and FINRA to enforce this new Best Interest Standard.

Does the financial advisor have conflicts of interest?

A major point of discussion when it comes to fee-only vs. fee-based advisors is conflicts of interest. Some feel that advisors who are licensed to receive commissions have a built-in conflict of interest because they might be tempted to sell products that pay them higher commissions. It is true that conflicts can exist for fee-based advisors, but conflicts exist for every advisor, including fee-only ones. For example, a fee-only advisor might advise a client not to pay off a mortgage or not purchase insurance because the client would use funds the advisor is managing. In either case, it lowers the amount of money the advisor is managing, thus lowering the annual fee he receives. Every professional, including financial advisors, lawyers, and CPAs have some conflict of interest directly or indirectly. Your advisor should disclose the services she provides, how she is paid, and demonstrate how her recommendation is financially in your best interest, regardless of whether she is a fee-only or fee-based advisor.

What is the financial advisor’s overall level of qualification?

Just because an advisor is a fiduciary does not necessarily mean they are a quality financial advisor, regardless of whether they are fee-only or fee-based. Knowing how they get paid does not answer the fundamental question of whether they are qualified to help solve the client’s problem. The license and registration to be an investment advisor representative is the minimum standard to legally practice professional investment advice, but it’s important to look beyond the license, registration, and fiduciary label. Does the advisor have an advanced degree or certification such as CPA, CFP®, or CFA? How many years of experience do they have? Do they have any client complaints on their record https://brokercheck.finra.org/? Do they have experience specifically in the area where you need financial support? Are they qualified to work with the widest breath of solutions and navigate the complexities necessary to solve your overall wealth management and wealth transfer goals?

There are many quality fee-only and fee-based financial advisors in the industry. The key is for you to seek the clarity and transparency you need to find the right fit for you. Ask hard questions. Insist on good answers. Get things in writing. Don’t be embarrassed if you are unclear or don’t understand. Keep asking questions until you do. The best financial advisors will welcome the questions, and ultimately provide you with the clarity and confidence to move forward and make the right decisions.