By Geoff Moore, Chief Information Officer, Valmark Financial Group (aka Chief Data Nerd and Lawn Robot Enthusiast)

In a world increasingly shaped by AI (Artificial Intelligence), the financial advisory industry is no exception. The AI Index 2024 Annual Report by Stanford University found that in 2023 alone, $2.13 billion was invested in AI for Fintech, placing it among the top six categories of private AI investment.1

Firms making these investments are aggressively marketing their solutions alongside general AI solutions. With such an overwhelming number of AI tools flooding the market, financial advisors often face ‘analysis paralysis,’ causing them to do nothing and miss the transformative benefits these

technologies can offer.

To cut through some of the noise, here are four practical and impactful ways financial advisors are successfully incorporating AI into their practices. (Note: Before using any tools, make sure to follow your firm’s compliance and security policies.)

In the words of Josh Brown, CEO of Ritholtz Wealth Management, “AI notetaking to save advisors and clients time before and after meetings is the most obvious killer app for our industry.”

AI notetaking is the ability to record a conversation with a client. It can be in the form of a remote, in-person, or phone meeting. AI notetaking builds on decades of transcription technology, offering advanced summarization and task management features that save advisors significant time and effort.

Here’s how it works and can benefit an advisor:

| 1. | Summarization: Modern note takers can summarize an hour-long meeting into key bullet points. It also allows advisors to create their own templates and feed the summaries into a format of their choosing. |

| 2. | Task Creation: AI note takers can also pick out the key tasks, sync them to a CRM and allow teams to work more efficiently. |

| 3. | Knowledge Repository: Finally, AI note takers allow advisors to ask questions from past meetings and even connect to other data sources such as email or CRM systems. Some reports suggest that up to 40-60% of the data about a client is contained in the meeting. Certain key pieces of information are never stored in a CRM. For example, would you ever think of recording all names of all grandchildren, their birthdays, and other extraneous details in a CRM? Probably not, but if the client mentions it in a meeting, an advisor can just simply ask their AI notetaking tool, “What are the names of my client’s grandchildren again?” AI would simply respond with the answer. |

Simplify Complex Estate Planning With AI-Assisted Tools

Jeff McMillan, head of AI for Morgan Stanley, said that after AI note takers, he would pursue an AI-assisted Estate Planning tool.

Estate planning often involves two challenges: drafting and executing plans and making them understandable for clients. AI tools are transforming this space by simplifying document generation, connecting clients with legal professionals, and creating visual diagrams to make plans more easily understood by both clients and advisors.

With $90 million recently raised by two FinTech firms betting big in this space, technology is rapidly advancing to streamline estate planning workflows and improve client experiences.

AI tools now simplify data extraction, turning complex PDFs and policy documents into actionable insights within minutes. This efficiency allows advisors to spend more time on analysis and less on manual data entry. Extracting and organizing policy data that previously took hours can now be done in seconds using generative AI prompts.

A simple prompt like:

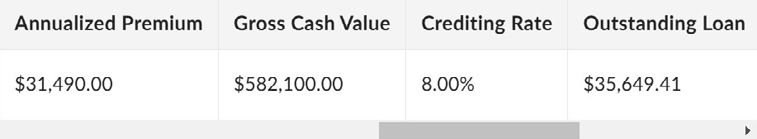

…can result in a clean table like the below for an advisor to copy and paste to Excel.

Boost Engagement Through Marketing

According to the AI Index Report, personalized marketing is the second most adopted use case for generative AI after drafting text documents.

While much has been written about using generative AI tools such as Microsoft Co-Pilot or ChatGPT, there are also specialized applications built for financial advisors that have prebuilt prompts to help quickly deliver key messages.

Also, incorporating video into your marketing strategy is no longer optional. With LinkedIn’s new ‘Shorts’ feature, video posts are five times more likely to spark conversations, making them a must for advisors aiming to connect with clients. Today through AI technology, you can record a 30-second update on market trends using your smartphone and an app such as CapCut, add captions via an app such as Submagic.co, and post a polished video to LinkedIn—all within minutes.

A Final Note

In my role, I get the opportunity to work with numerous startups and see over the horizon on what is coming. Every day, I am amazed by the creativity of those in our industry and how they are creating solutions to make the lives of advisors and their clients better.

These four AI applications are just the beginning of how technology can revolutionize the financial services space. By embracing AI, advisors can save time, improve client interactions, and stay ahead in an increasingly competitive industry. Start small, explore the tools that resonate with your practice, and see how AI can help you elevate your services and deliver greater value to your clients.

Sources:

1. Standford AI Index Report 2024, page 254