Life Insurance 10X

What would it mean to you to have a tell-tale book about life insurance that lays out an all-inclusive game plan, including several tactics and strategies, for dramatically improving the end-to-end client experience by ten times (10X)? In Life Insurance 10X, fourteen of the nation’s foremost insurance professionals share their experiences and thoughts for revolutionizing the way life insurance is perceived and implemented today.

About the Book

The life insurance industry is on the precipice of a major shift. Just as Uber brought disruption to public car service, a consumer-focused approach is underway to replace the sales-oriented process we know today.

“Life insurance is the last product in the financial world that needs to come to consumers on their own terms. It drastically calls out for transformation that is built around the customer, not legacy systems of various life insurance companies, arcane paper-based processing, and data that is stale.”

In Life Insurance 10X we hear from 14 foremost professionals who are helping to usher in that change. Here they share specific processes and tools to make the end-to-end experience “ten times better” (10X) as policyholders search for, obtain and preserve a life insurance policy to safeguard their future and their wealth. An easy read for anyone outside the industry, it shines a light on what to look for (and look out for) yet is packed with real-life examples and specific recommendations to shepherd life insurance into the 21st century.

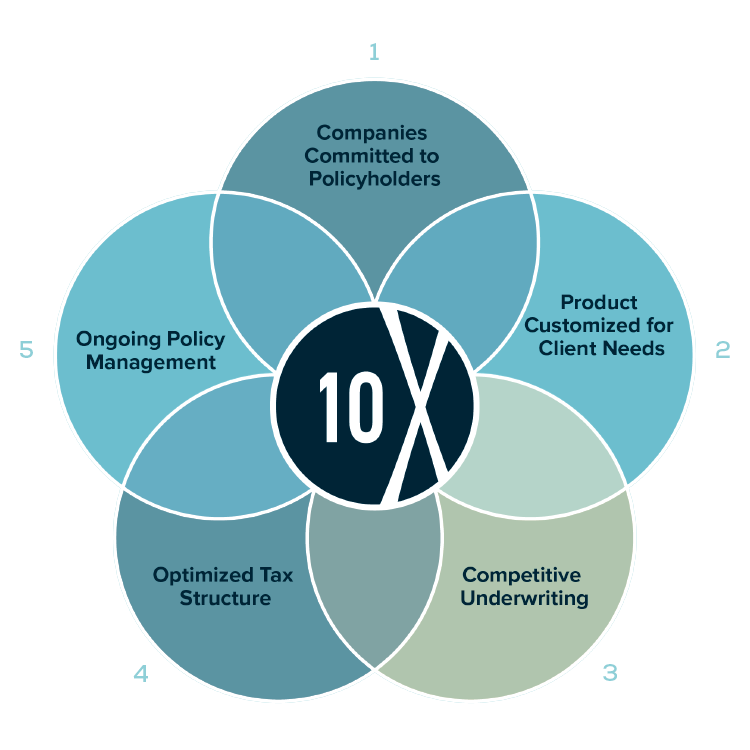

In “Life Insurance 10X”, the 14 co-authors catalogue best practices for successfully transforming the life insurance experience for clients, based on five core principles:

Recommend and work only with those companies that display evidence of staying committed to policyholders over the long-run.

Find, design, and obtain a policy using a consistent, advisory-based process centered squarely on addressing the policyholder’s individual needs.

Utilize a unique, fact-gathering underwriting process that strives to obtain the best underwriting class while maintaining the client’s confidentiality.

Optimize the structure and design of the policy so that the client benefits from the unique tax advantages that life insurance brings.

Put in place ongoing monitoring and management of the policy over the long-run to ensure the policy’s performance continues to meet the client’s expectations and needs.

Hear from the Authors

David S. McKechnie, CLU®

Frederick V. McNair IV

Michael B. Dranoff

Fulcrum Partners, LLC

Koss Olinger

What People are Saying

Other Life Insurance 10X Resources

Disclosures

The material contained in this book is for informational purposes only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors.

Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice.

This material is intended for informational purposes only and should not be construed as legal or tax advice, or investment recommendations. You should consult a qualified attorney, tax adviser, investment professional or insurance agent about the issues discussed herein.

Securities offered through Valmark Securities, Inc. Member FINRA/SIPC. Investment advisory services offered through Valmark Advisers, Inc., a SEC Registered Investment Advisor.

130 Springside Drive, Akron, Ohio 44333. (800) 765-5201. FINRA | SEC | SIPC |MSRB | ©2024 Valmark Financial Group | All rights reserved.